Exploring investment opportunities in Canadian Mortgages

As of Q1 2024, Mortgage Investment Corporations (MICs) played a significant role in the Canadian mortgage landscape, funding roughly 8.4% of new Canadian mortgages. This presents a compelling opportunity for investors to gain income-generating exposure to the real estate market, building towards their long-term financial goals. But how does this actually work without direct ownership or tenant headaches?

The Canadian economy, like any other is subject to fluctuations, and strategic investing plays a key role in building wealth and achieving long-term financial stability. Understanding the various investment options available is essential for navigating these economic shifts and positioning yourself for success.

What you’ll learn in this guide:

- What MICs are and how they work.

- Key benefits (yields, diversification, professional management).

- How PHL’s funds match different risk tolerances.

- Eligibility requirements, and next steps to get started.

What is a MIC?

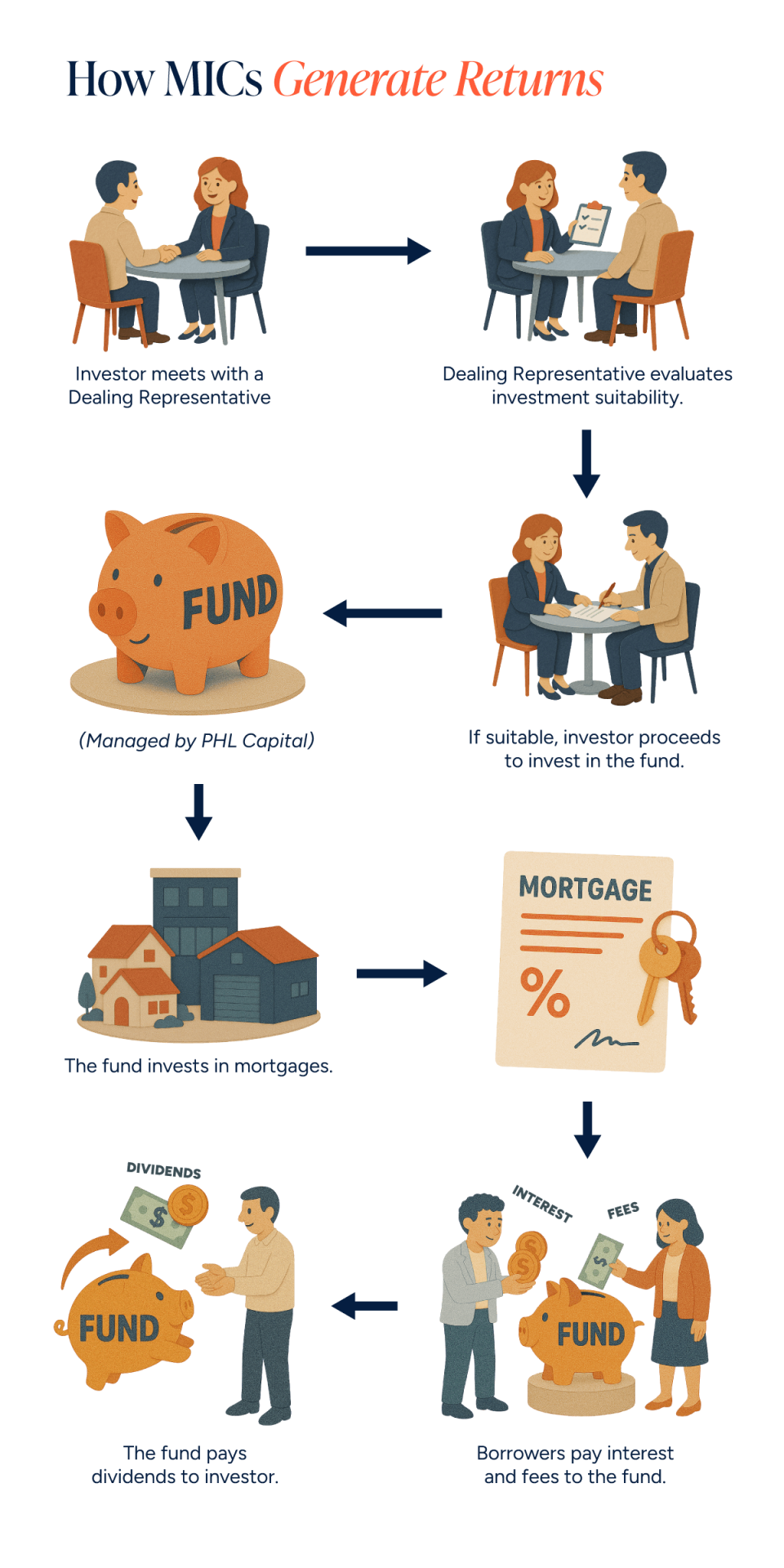

A Mortgage Investment Corporation (MIC) is a Canadian company that pools investor funds and lends them as mortgages—often for borrowers who don’t meet traditional bank criteria.

MICs are regulated under the Canadian Income Tax Act, ensuring strict rules around income distribution and eligible investments to protect your investment in RRSPs, RRIFs, TFSAs, or RESPs.

Unlike traditional banks or credit unions, MICs specialize in mortgage lending, allowing for a focused approach within the real estate finance sector. MICs connect investors with opportunities in the Canadian mortgage market. This specialization can lead to greater flexibility and tailored solutions for borrowers, and potentially attractive investment opportunities for investors.

MICs operate under a specific regulatory framework, designed to ensure compliance and investor protection. While they are not banks, they are subject to rules governing their operations, including how they distribute income and the types of investments they can hold.

The Benefits of Investing in a MIC

For investors seeking to diversify their portfolios and generate income, MICs like MortEq Lending Corp. (“MortEq”) and Oakhill Lending Corp. (“Oakhill”), which are both managed and operated by PHL, can present several compelling benefits.

- Access to the mortgage market: MICs provide an avenue for investors to participate in the mortgage market without the need for direct involvement in mortgage origination, underwriting, and management. This passive investment approach allows investors to gain exposure to real estate debt with relative ease.

- Potential for regular income distribution: MICs distribute all of their net income as dividends, making them a great choice for income-seeking investors.

- Professional management and expertise: Funds in a MIC are managed by experienced professionals who possess in-depth knowledge of the mortgage market. These managers handle the complexities of loan origination, underwriting, and administration, relieving investors of the burden of direct mortgage management.

- Transparency and reporting: PHL prioritizes transparency when it comes to operations and provides regular reporting to their investors, ensuring they are informed about the performance of their investments and overall health of the fund they have invested in.

The potential benefits, combined with careful management and due diligence, can make a valuable component of a well-rounded investment strategy.

How We Prioritize Capital Preservation

The security of investing in a MIC fund is fundamentally linked to the security of the underlying mortgages held by the MIC. In Canada, mortgages are secured by a legal instrument known as a charge on the property title. This charge gives the lender (e.g. the MIC) a security interest in the property, meaning that if the borrower defaults on the mortgage, the lender has the legal right to take possession of the property and sell it to recover the outstanding loan amount. By using proven and established underwriting methods, PHL mitigates risk through geographic diversification and thorough capital preservation strategies.

Several factors contribute to the overall security of MIC investments:

- Loan to value ratio (LTV): depending on which fund you invest in, risk is mitigated by PHL actively managing the LTV of every mortgage.

- Underwriting process: this process calls for assessing the borrower’s credit worthiness and ability to repay the loan. A rigorous underwriting process is crucial to ensure that the MIC is lending to a qualified borrower. At PHL, we pride ourselves on our thorough due diligence and underwriting procedures.

- Property appraisal: working with a list of approved appraisers, all mortgage applications require a current appraisal to determine the property value, which is essential for determining the appropriate loan amount and LTV.

- Mortgage security: an experienced team of legal professionals review and prepare all mortgage security.

- Credit committee: Our experienced credit committee reviews every mortgage, ensuring only qualified borrowers are approved to preserve investor returns.

- Strategic lending area: PHL generally focuses on providing financing for Canadians where the market exhibits long-term stability, growth and liquidity.

Capital preservation is a key concern for investors. This is why we place a strong emphasis on rigorous risk management practices, including thorough due diligence, careful underwriting, and ongoing monitoring of our mortgage portfolio.

The Role of MICs in the Canadian Mortgage Market

Canada’s stricter B-20 stress-test rules and evolving borrower profiles have pushed more applicants outside the big-bank “box.” As a result, alternative lenders, including MICs, captured 8.4% of newly extended mortgages in Q1 2024, up from 5.2% in Q1 2022. For investors, this underserved demand converts into a potential steady stream of interest income backed by tangible real-estate collateral.

MICs purposefully serve a vital niche within the Canadian mortgage market, stepping in to provide financing solutions where traditional institutions often cannot. Here is how MICs play a role in the Canadian Mortgage Market:

Non-Conventional Properties

- Small multi-family, mixed-use retail, bare land, or unique titles often fall outside bank guidelines. MICs evaluate these assets on real-time value and exit strategy rather than rigid policy boxes.

Borrowers With Unique Circumstances

- Self-employed entrepreneurs, new Canadians, or clients with temporary credit blemishes leverage MIC flexibility to close deals quickly and obtain mortgage financing.

Construction Financing

- Stage-draw loans keep infill builds or major renos moving—capital traditional lenders may only release only after completion.

Bridge Financing

- Short-term funding (3-12 months) covers the gap between a sale and a subsequent purchase, protecting equity and timelines.

By providing these alternative financing options, MICs play a crucial role in facilitating real estate transactions and contributing to economic growth within Canada.

PHL’s Mortgage Investment Offerings

PHL offers two distinct mortgage investment corporation opportunities, each meticulously structured to cater to the diverse preferences and risk tolerances of our investors.

| MortEq Fund | Oakhill Fund | |

| Target Returns | 6-10% net of fees* | 10-14% net of fees* |

| Loan Types | 1st/2nd mortgages | 1st/2nd/3rd mortgages |

| Property Focus | Residential, commercial, industrial | Residential, commercial, industrial |

| Investor Eligibility | Eligible and Accredited Investors | Accredited investors only |

*Based on historical averages. As of April 30, 2025. Past performance does not guarantee future performance.

Both MortEq and Oakhill are managed in accordance with PHL’s commitment to rigorous underwriting standards and careful due diligence procedures. This dedication to quality ensures the strength and stability of the underlying mortgage assets within each fund.

Each quarter, shareholders are entitled to receive any dividends declared by Oakhill or MortEq. Investors will have the opportunity to either take a cash payment, or reinvest their dividends as a purchase of additional shares. As an incentive to reinvest, additional shares purchased through the reinvestment of dividends will qualify for future dividends.

Q1

Sep 1 – Nov 30

Dividend paid out by December 31st

Q2

Dec 1 – Feb 28

Dividend paid out by March 31st

Q3

Mar 1 – May 31

Dividend paid out by June 30th

Q4

Jun 1 – Aug 31

Dividend paid out within 90 days of August 31 fiscal year end

Who Can Invest with PHL

PHL’s investment opportunities are designed to be accessible to a diverse range of investors who meet specific eligibility criteria. These criteria are subject to variation depending on the particular investment product and the prevailing regulatory requirements.

Generally, eligible investors may include:

- Accredited investors– individuals and entities that meet specific financial thresholds related to income or net worth, demonstrating a higher capacity to assume investment risk

- Institutional investors– participation from institutional investors seeking stable, income-generating investments

- Sophisticated investors– investors who may not be formally classified as “accredited” but have a demonstrated understanding of financial markets and investment risks may be eligible

Partnering with PHL: Building a Stronger Financial Future

Choosing to invest in Canadian mortgages through PHL represents an opportunity to participate in resilient markets, all while benefiting from the expertise, dedication, and trusted partnership of a leading mortgage investment provider.

We firmly believe that our relationship with investors extends beyond the provisions of financial products. We recognize that investors seek a trusted partner, an organization that not only prioritizes their financial objectives but also operates with the utmost integrity and unwavering dedication to their needs.

Ready to take the next step?

To learn more about how you can invest, send us a prospective investor application, or reach out to our investments team:

Ravi Munday | VP, Investments | [email protected]

Brianna Ahluwalia | Dealing Representative | [email protected]

Kristen Patton | Dealing Representative | [email protected]

Tali Aldous | Client Services Officer | [email protected]